The life of a solo entrepreneur seems so easy.

One look at social media feeds, under the relevant hashtag, and you are barraged with a constant stream of short video clips and enticing pictures of people running their business at fancy coffee shops and luxurious spas, free from worry, confident in their appearance.

What don’t you see? You don’t see the stark reality of solo entrepreneurship.

The perpetual context switching. One moment you’re trying to close a new deal, and at the same time, you’re putting finishing touches on a project due anytime.

Money Note: If an extra $1K–$5K/month would change your 2026 goals (debt, savings, travel, freedom), you’ll want to catch this: free live workshop from a freelancer who’s earned $4M+ online. No fluff. No gimmicks. A real roadmap. 👉 Watch the training or save your seat here »

The indefatigable chase for invoice payments. Yes, you have a lot of paying clients, and the business is doing great. But sometimes clients forget to pay, and sometimes you forget to send a reminder.

This is the cost of being your own boss. You only have two hands and your business needs a hundred.

But there is one simple, proven strategy to help you make this reality simpler to control. It’s called micro-systematization.

This article will explain what micro-systematization is, its benefits for your solo business, and more importantly, how you can use it in your day-to-day life.

Understanding Micro-Systematization

Micro-systematization is the strategic process of breaking operations of your solo business into small, well-documented (critically important), and repeatable procedures.

It is different from full-scale business systematization, which can be difficult, and in most cases, an unnecessary undertaking for a lean operation.

With micro-systematization, you don’t reshape every workflow at once. Instead, the focus falls on identifying and refining the most impactful, albeit the smallest, processes that have an effect on your revenue, client relationships, or time spent working.

For a solopreneur or freelancer, the idea is not to do away with work but to ensure that the work performed, from sending a proposal to completing a client project, is done with the same level of quality every single time.

Micro-systematization is the practice of building the load-bearing support for your business one beam at a time.

The emphasis on little parts is hard not to emphasize because the average entrepreneur spends 36% of their work week on small administrative tasks like invoicing, data entry, task management, etc.

Why Starting Small Is the Winning Strategy

When solopreneurs think about systematization, they imagine a complex, time-consuming effort of designing flowcharts and organizing massive procedure binders.

Since micro-systematization is not about that, your efforts shift to changing how you perform your job and which tools you use.

So, why is starting small best?

1. Low Risk, Easy Adjustments

Changes to small processes are easier to do as they don’t need large time and capital investments. If a documented process proves to be ineffective or inefficient, it’s easier and faster to ditch it or readjust.

2. Instant Time-to-Value Results

By documenting and refining one key, repetitive task, like client onboarding, for instance, you not only make the procedure effective, but you gain confidence and momentum to take on the next challenge.

3. Compound Power of Small Systems

Incremental improvements compound. Every task systematized successfully frees up your time, reduces errors, and leads to predictable, positive results. Expert delegators report a mean revenue increase of 143% compared to non-experts.

Key Benefits of Micro-Systematization

Micro-systematization is not merely about saving your time; it’s a foundation upon which you can build and scale your business indefinitely. It alleviates the common challenges that keep solopreneurs down.

- Freeing both time and mental energy: A clear, systematic approach coupled with automations allows solo businesses to run a sizable share of their work activities autonomously using currently available tools.

- Establishing control and consistency: Documented procedures make it so every client interaction and deliverable adheres to the standards you set, building your reputation for reliability.

- Helping to scale and delegate: Micro-systems serve as training manuals you hand to virtual assistants or contractors. When you’re ready to delegate, you can move from doing everything to managing a profitable operation.

- Protecting your business expertise: Documentation preserves your best practices and minimizes the risk of knowledge loss if you need time off.

After getting to know the benefits, it’s time to move from theory to execution. To make this simple, the entire process of micro-systematization will be broken down into seven practical steps.

7 Steps to Micro-Systematize Your Solo Business

Micro-systematization is all about practice, with rapid, result-driven cycles rather than purely theoretical modeling.

Step 1: Examine Your Workflow and Pinpoint Key Tasks

Identify key tasks of your work week. These typically consume a lot of time (more than 3 hours weekly), are highly repetitive (sending follow-up emails, recurrent billing), or tied directly to your revenue (proposal generation).

For a web designer, this might be talking to clients and collecting feedback on projects or their individual parts.

A content writer, for example, may spend a lofty amount of time creating professional invoices and tracking payments.

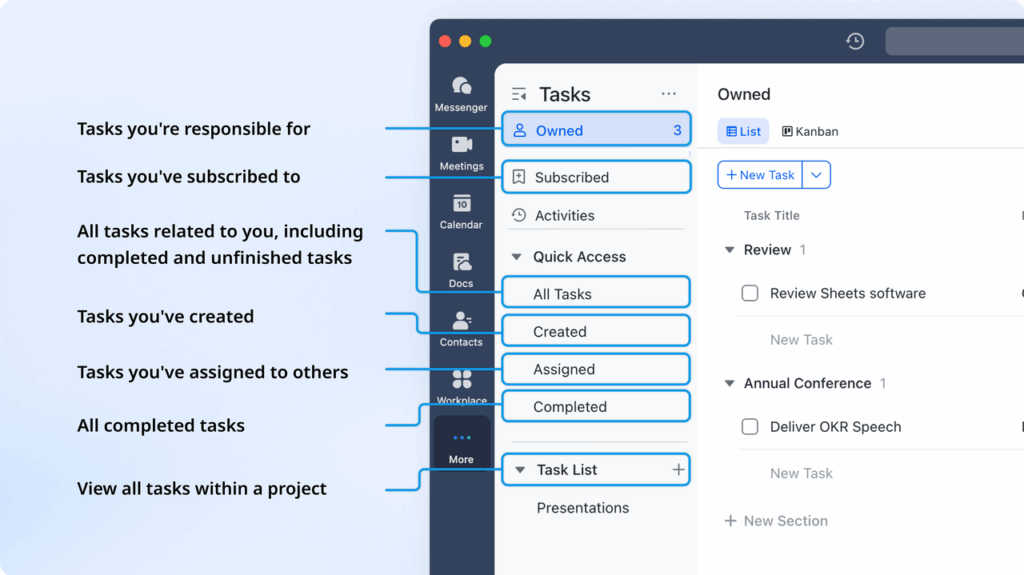

To make this audit easier, track spent time in your work management app.

Step 2: Map Your Current Process

Outline the selected task in simple steps. Use basic checklists, visualize with Kanban board stages, or draw a mind map flowchart. The outcome should be as accessible to you as to an outsider unfamiliar with the task.

In a work app like Flowlu, you can visualize steps as Kanban stages or prepare a mind map.

- Important: Don’t fix anything during the mapping process; record everything as it exists today.

Step 3: Define the Minimum Viable System (MVS)

The MVS principle helps you avoid going beyond the scope of work by having you set your sights on the smallest procedure that achieves the desired outcome.

For example, if the task is client onboarding, the MVS might only include preparing the contract and setting up the project workspace, while avoiding the complexity of an introductory client training session.

The MVS should always prevent you from over-documenting.

Step 4: Document with Usability in Mind

Lengthy manuals tend to be ignored, even if you have prepared them for yourself.

Instead, try:

- Tasks with subtasks: For sequential tasks that require multiple steps to complete (set “Weekly Content” as the main task with subtasks for “Source 5 Relevant Articles”, “Post 3 Social Captions”, “Schedule Posts in Buffer”, and “Monitor Comments”).

- Screen-recorded tutorials: For complex software procedures where a visual guide is easier to follow than text (“Exporting Assets for Web”, “Running a Backup on a WordPress Site”, etc.)

- Mind maps (flowcharts): For processes that involve making decisions (if the client does not pay in 7 days, send a reminder).

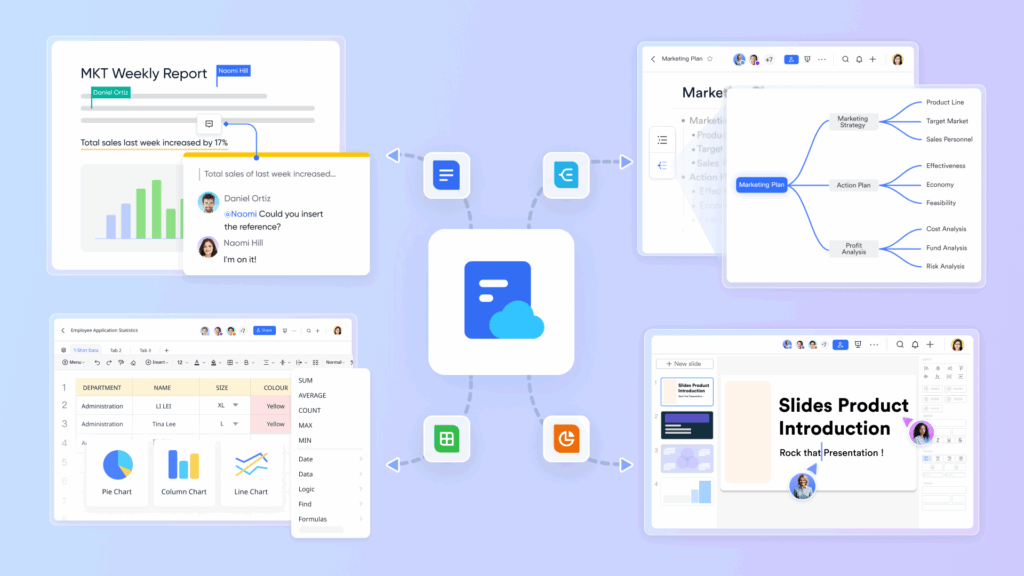

- Knowledge bases: For written documents and SOPs that you will need to organize, search, and access instantly. Flowlu’s knowledge base is the ideal place to store your information and link it to projects and clients.

Step 5: Use Automations and AI in No-Code Tools

Now your documentation efforts will pay off. Use low-cost, no-code tools and large language models to automate the tasks that can be successfully accomplished by following recorded steps.

These tips will help you apply the automation to the process you just documented:

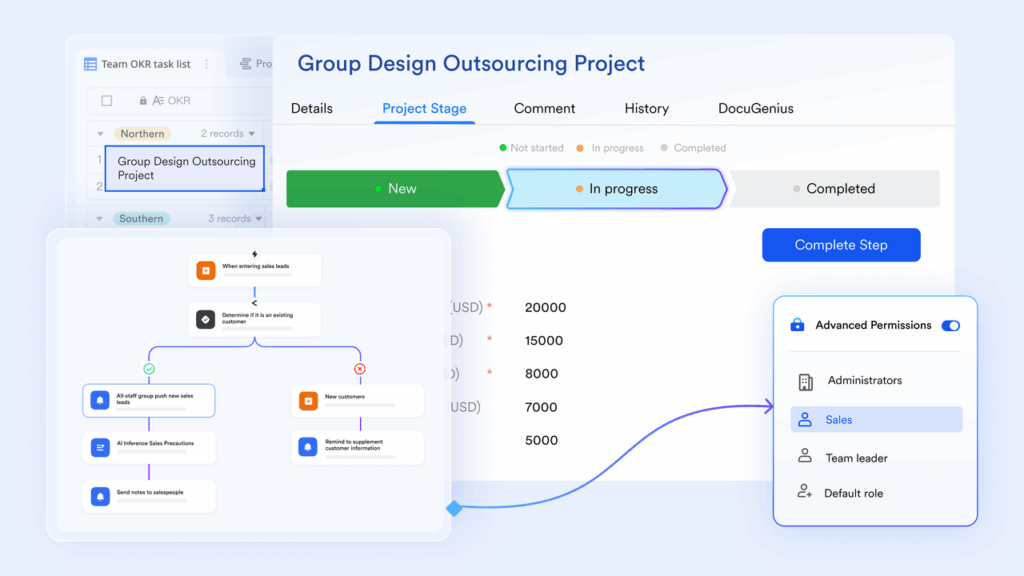

- Look for work management tools that natively connect your business functions. For example, in Flowlu you can set up automated workflows like sending an email or scheduling a call once your deal moves to the “Proposal” stage.

- For apps that don’t directly integrate, use specialized apps like Make or n8n. These are perfect for setting up a cross-platform sequence, such as when a new keyword suggestion is pulled from Ahrefs or SEMrush, and then tagged by difficulty score.

- Run repeatable content generation and data analysis tasks with AI tools Google Gemini, Claude AI, or ChatGPT. You can automate the drafting of standard emails, compare website pages (URL context and agent mode for Gemini, and agent mode for Claude AI and ChatGPT).

The goal is to set up an “if this, then that” scenario and speed up work. You can delegate tasks that require no creative thought and simplify the preparation for tasks that do need it.

Step 6: Test and Readjust

A system is not ready to be used when it is documented. It’s good to go when you know that it is reliable. The most dangerous thing for a solopreneur is to automate a faulty process, as this simply builds in a flaw in a faster workflow.

You are your own quality control. Run the documented and automated process with your next few real projects.

When testing, recall these tips:

- Self-correction: Did the automation trigger exactly as you expected? Did you have to stop and think during any setup step? If these things happen, rework your documentation and reassess the system you’re using.

- External feedback: If the system is client-facing (onboarding, project closure), ask the client for brief and honest feedback on the whole experience. Make sure that your efficiency does not sacrifice the human touch.

The process of testing and readjusting should be fluid. Imagine a system that causes zero issues for both you and your clients; this is the system you need to build. Once it is ready, move to the final step of measurement.

Step 7: Monitor Main Metrics

The system is truly valuable if it’s working for your business. Measure the performance by tracking indicators that can prove that the system saves you time and gets you consistent, predictable results.

Metrics that have to be tracked are the original pain points you identified in Step 1.

These can include:

- Turnaround time (TAT): Is your process much faster now? Did you cut a 3-hour task (like creating and sending an invoice) down to 45 minutes?

- Error rate: Are you still making mistakes? A high error rate points to an implementation flaw that you should document and fix.

- Client satisfaction: This is harder to quantify. What you should do is monitor retention rates or simply ask for a satisfaction score after the deal is done.

Monitoring these metrics can help you validate your system and also give you the answer to the question: Which process should I micro-systematize next?

Composing and sending emails is a pain for solopreneurs and a perfect target for micro-systematization.

Let’s investigate how this process can be streamlined in Flowlu.

The goal for the system is to speed up sales, and the MVS would be the system that ensures email messages are sent to the client at relevant stages of the pipeline.

Instead of relying on several tools, you can set up full sequences directly in Flowlu. Just add an automation for a welcome email to stage “New”, a proposal email to “Proposal Sent” stage, or next steps email to “Closed” stage.

Stop Hustling, Start Building

You are well familiar with the reality of solopreneurship: the constant switching, the missed deadlines, the exhaustion. This happens because one’s business runs on memory instead of documented steps.

With these 7 micro-systematization steps, you can stop the chaos from overtaking your life by establishing reliable processes that will benefit you and your company.

Keep the conversation going…

Over 10,000 of us are having daily conversations over in our free Facebook group and we’d love to see you there. Join us!