Note: This article contains legal advice. We recommend you consult a lawyer before making legal decisions in your business.

Freelancing is on the rise like never before. In 2023, 73% of U.S. workers planned to freelance. An astonishing 46% of the global workforce is self-employed. In 2023, 72% of Gen Zers planned to leave their jobs to work for themselves. These numbers show that freelancing is more than a trend. It’s shaping the future of how and where we work.

The appeal is undeniable: flexibility, autonomy, and the chance to be your own boss. But freelancing is more than just picking a service to offer or setting your own hours. You need to begin with a strong foundation to build a successful, sustainable freelance business. The key is to structure your business properly from the outset.

Many freelancers first set up an LLC to professionalize their business. An LLC provides legal protection, tax advantages, and credibility with clients. But, the process can be tricky. Common mistakes can have costly effects.

Get Weekly Freelance Gigs via Email

Enter your freelancing address and we’ll send you a FREE curated list of freelance jobs in your top category every week.

This article will cover six common mistakes people make when starting a freelance LLC. Most importantly, we’ll show you how to avoid them. This will help you set up your freelance business for long-term success.

Why should you set up an LLC?

For freelancers, an LLC is a great way to protect your business and personal assets. An LLC separates your personal and business finances. It protects your home, savings, and belongings from debts or lawsuits tied to your freelance work.

Beyond protection, an LLC also boosts your professional image. Clients see LLCs as more credible than sole proprietors. So, it’s easier to get high-paying contracts and long-term relationships. This added professionalism can set you apart from competitors and open the door to more opportunities.

An LLC also brings significant tax benefits. It allows for pass-through taxation. Business income is reported on your personal tax return. This may simplify your tax process. If you earn more as a freelancer, choose S-Corp tax for your LLC. It can reduce your self-employment tax and save you money as your business grows.

Finally, an LLC prepares you for growth. Whether you plan to hire subcontractors, form partnerships, or expand your services, an LLC provides the flexibility and structure you’ll need to succeed.

It’s a foundational step that positions your freelance business for long-term success. Even if you’re just selling digital products online or doing occasional gig work like consulting or graphic design, it’s worth considering setting up an LLC to protect your growing business.

What do you need to set up an LLC?

Setting up an LLC might seem daunting at first, but with the right preparation, it’s a straightforward process. Here are six key elements you’ll need to get started and ensure your freelance business is on solid legal ground.

1. Choose your business name

Every LLC needs a unique business name that complies with your state’s regulations. The name should not only reflect your services but also stand out to clients.

Be sure to check your state’s database for availability and confirm that the name includes “LLC” or “Limited Liability Company” to meet legal requirements.

In conjunction with establishing your business name is securing a domain name for your website. If your desired domain isn’t available, or if it’s too long or hard to remember, consider using a creative, memorable alternative.

For example, HJV Car Accident Personal Injury Lawyers opted for a unique URL, justicestartshere.com, to stand out while keeping things simple and effective.

By choosing a domain that’s catchy and relevant, you make it easier for potential clients to find and remember your business online.

2. File articles of organization

The Articles of Organization (also called a Certificate of Formation in some states) is the official document that establishes your LLC. You will need to file this with your state and pay a filing fee, which varies by location.

This document outlines your business name, address, and the name of your registered agent (a person or service authorized to receive legal notices on your behalf).

3. Create an operating agreement

Although not always legally required, an operating agreement is a vital document that lays out the structure and operations of your LLC.

It helps clarify roles, responsibilities, and decision-making processes, especially if you plan to expand or bring on partners later.

4. Obtain an EIN

An Employer Identification Number (EIN) from the IRS is necessary for tax purposes. Even if you don’t have employees, an EIN allows you to open a business bank account and simplify tax reporting.

The good news? It’s free to apply online through the IRS website.

5. Gather your documentation

Collecting and managing your business documents is a key part of the LLC setup process. Tools like Content Snare can simplify this step by helping you request and organize all necessary files, such as contracts, operating agreements, and tax forms, in one place.

6. Understand state-specific requirements

LLC regulations differ from state to state, so it’s crucial to research your state’s specific rules. Some states require annual reports or franchise taxes, which should be factored into your budget and timeline.

Is there a chance you’ll operate in multiple states? A company like Zehl & Associates is a law firm that serves clients across the United States and must be aware of nuances in LLC requirements in different states. Be sure you check state requirements in every state where you will do business.

6 mistakes freelancers make when setting up an LLC

If you want to survive and thrive as a freelancer, then you need to set your business up for success from the get-go.

Let’s look into 6 mistakes freelancers make when setting up an LLC and what you can do to avoid making these same mistakes.

Mistake #1: Choosing the wrong business structure

One of the first and most important decisions for a freelancer is choosing the right business structure. Many jump into freelancing as sole proprietors because it’s easy to set up. But, that doesn’t always provide the protection or flexibility needed as your business grows.

An LLC is better than a sole proprietorship. It protects your assets and boosts your credibility. Some freelancers choose an LLC. They don’t consider if an S-Corp tax election could suit them better. For example, if your freelance business makes good money, an S-Corp might reduce your self-employment taxes. It could help you keep more of your earnings.

Another mistake is overcomplicating things by choosing a C-Corp. It’s unnecessary for most freelancers. C-Corps face double taxation and extra rules. They clash with the simplicity freelancers seek.

The key is to assess your current and future business goals. If you want limited liability, manageable taxes, and room for growth, an LLC is often the best fit. A business attorney or tax professional can help. They can ensure you choose a structure that supports your long-term success.

Mistake #2: Not understanding state and local LLC laws

Each state has its own rules for LLC formation, taxes, and ongoing compliance. Not knowing these rules can lead to penalties, costs, or losing your LLC’s good standing. This mistake often stems from assuming all states operate the same way, but the reality is far more nuanced.

Some states must have annual reports and franchise taxes. Others have low fees and less frequent reporting. Also, consider local laws (like city business licensing requirements). Operating in many locations adds complexity. You must ensure compliance in every state or city where your business operates.

Consider Attorneys of Chicago, a law firm with offices in several cities in Illinois. Their strong presence across a state is an advantage for their business, but it means they must be aware of unique laws in different cities and counties. If you to grow your reach and become an LLC in multiple locations, you must navigate these issues.

To avoid any mistakes here, research your state’s requirements before setting up your LLC. If you plan to work with clients outside your home state, consult a lawyer to ensure compliance. Staying proactive about state and local laws helps protect your LLC. It also ensures smooth operations wherever you do business.

Mistake #3: Skipping or underestimating insurance needs

Don’t overlook the importance of insurance when setting up an LLC. It’s a critical safety net. Without adequate coverage, you’re leaving your business and personal assets exposed to potential risks.

For instance, if a client sues over a mistake in your work, professional liability insurance can cover legal fees and damages. General liability insurance protects you from claims of physical injury or property damage. Both can arise from everyday business interactions.

Even if your freelance work is entirely online, risks still exist.

Get insurance that fits your needs. It could be general liability, professional liability, or even health insurance (for yourself or staff if you have one). Simply, insurance protects your LLC. Once you’re protected, you can focus on growing your business without worry.

Mistake #4: Mixing personal and business finances

A common mistake freelancers make when setting up an LLC is not separating personal and business finances. Using your personal bank account for business transactions may seem convenient. But, it can blur the lines between your personal and business assets.

This not only complicates your accounting but can also weaken the liability protection your LLC provides.

To avoid this, start by opening a dedicated business bank account. Use this account only for business income and expenses. It helps you track your finances, manage taxes, and keep records. Most banks offer business accounts for small businesses and freelancers. They often include perks like online banking and accounting software integrations.

Next, establish a system for managing finances. Tools like invoicing software and finance apps can simplify tracking income and expenses. These tools help you spot trends in your earnings. They also help you plan for tax payments and keep your business profitable.

Finally, remember that consistency is key. Keeping your finances separate isn’t just for easier taxes. It shows clients, collaborators, and investors that you run a professional, organized operation. Doing this before you launch as an LLC will save you time and stress. It will also prevent any potential legal problems later on.

Mistake #5: Ignoring tax obligations and overlooking possible deductions

Taxes can be a daunting part of freelancing. For new LLC owners, they can be even more complicated. Not knowing your tax obligations or missing deductions can waste time and money.

As an LLC owner, you must pay self-employment taxes. This tax covers Social Security and Medicare. Additionally, you may need to make quarterly estimated tax payments to avoid penalties at the end of the year. The key is to stay organized and plan! Consider using accounting software or hiring a tax professional to help you manage your obligations.

One of the perks of an LLC is the ability to claim a wide range of tax deductions. Common deductions include home office expenses, internet and phone bills, software subscriptions, professional development courses, and travel costs for work. Keeping detailed records of your business expenses will help you save. It will ensure you don’t miss valuable opportunities to do so.

Of course, you want to make sure that whatever you deduct from your taxes is a true business expense. Don’t try to cheat the system. It can put your personal and business finances at risk and is not worth it.

If you’re overwhelmed by taxes, consult a CPA. One with small business experience can help a lot. They can help you with complex tax rules, optimize your deductions, and decide if your LLC should elect S-Corp status to cut self-employment taxes. Proactive tax planning is an investment in your business. It helps you stay compliant and maximize your profits.

Mistake #6: Neglecting to seek professional help when needed

As a freelancer running an LLC, you might be tempted to do everything yourself. But this can lead to costly mistakes. Professionals like lawyers and accountants can protect your business from avoidable risks.

A lawyer can help you create strong contracts, ensuring you’re protected in case of disputes with clients. An accountant can help you understand tax laws, find deductions, and set up a financial plan that fits your business needs.

Without expert guidance, you risk making costly errors, whether it’s filing taxes wrong or using ineffective contracts. But getting professional help doesn’t have to be expensive. There are affordable services available for small business owners, such as online legal platforms or freelance accountants.

Investing in professional help at the right time can save you money and prevent bigger problems down the road. Don’t wait for an issue to arise. Seek advice early to help protect your LLC and give you peace of mind as your business grows.

Bonus tip: Don’t overlook branding and marketing as you set up your LLC

While structuring your LLC is crucial, neglecting your branding can be an equally costly mistake. Your brand is the face of your business, and it’s often the first impression clients have of your work. From day one, branding sets the tone for how your freelance business will connect with its audience and stand out in a crowded market.

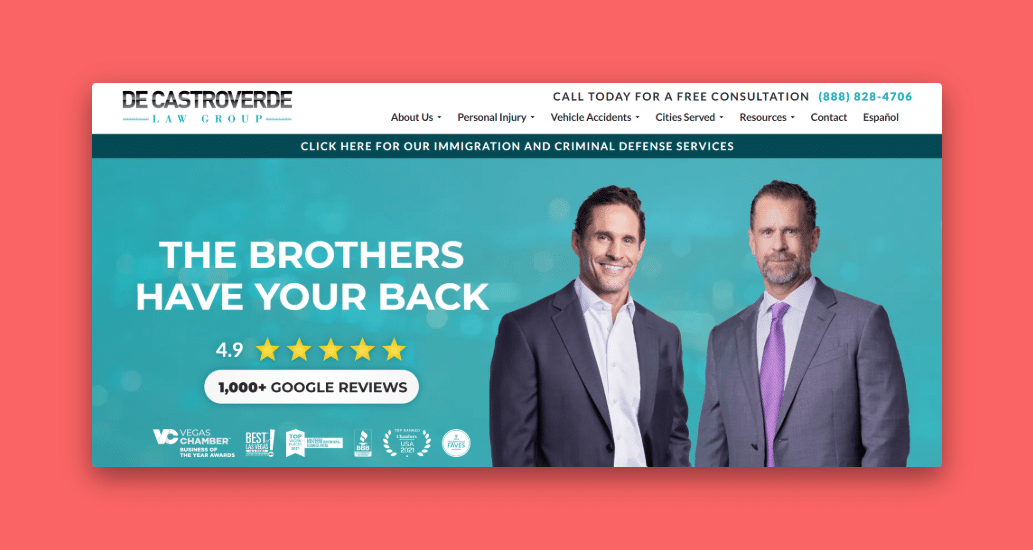

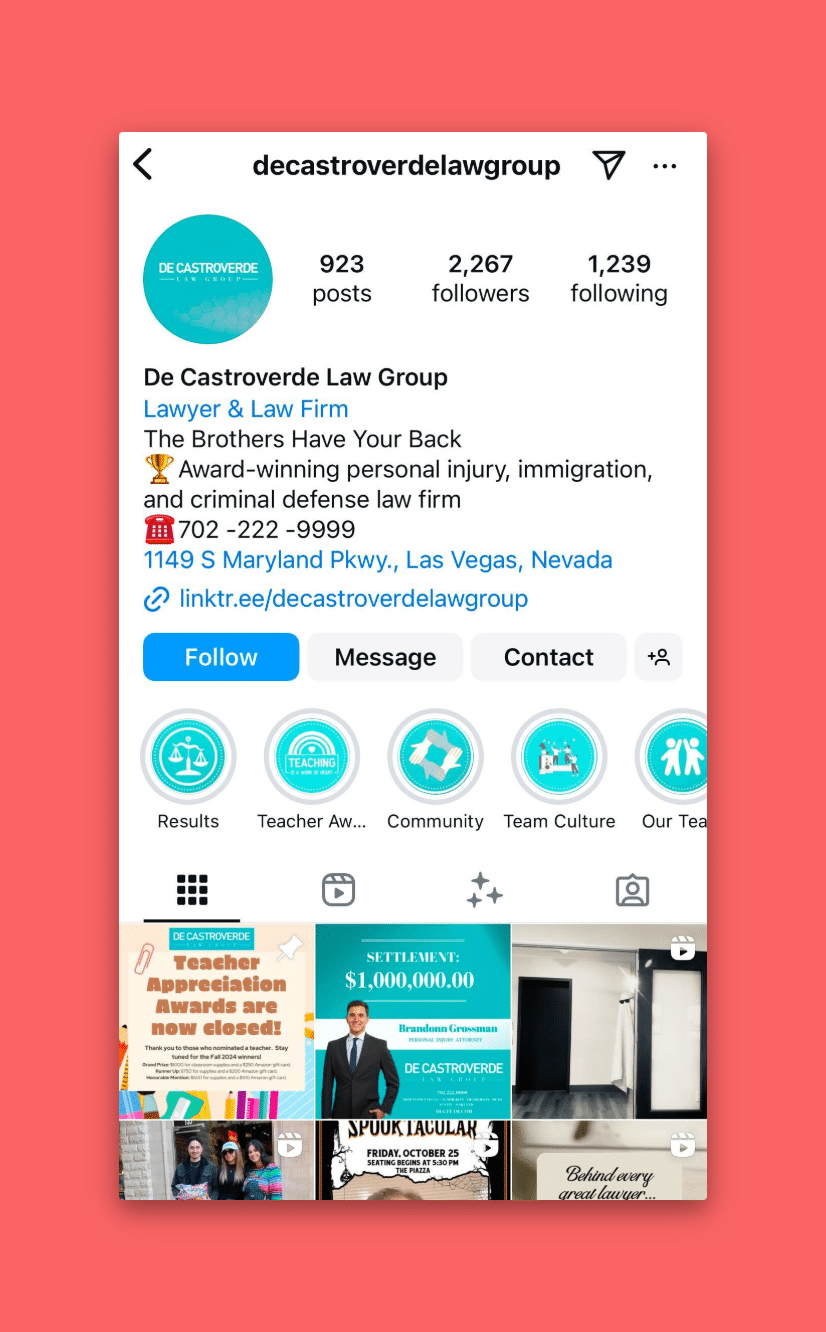

Your brand is how clients perceive and connect with your business. It’s more than just a logo or name—it’s the story, tone, and values that set you apart. Consistency is crucial, as seen with DLG Team, which uses cohesive branding across platforms, reinforcing professionalism and memorability.

When clients move from website to social media, it’s important to maintain consistency with color schemes, graphics, and message tone. Notice how their Instagram page reflects their website:

A strong brand also tells a story: why you freelance, what makes your services unique, and how you solve client problems. Paired with effective marketing, your branding can establish authority and help you reach the right audience at the right time.

To be successful:

- Choose a memorable name for your business

- Design a logo and select colors that represent your identity and vibe

- Develop brand standards to ensure uniformity across your website, emails, and marketing materials

- Create a mission statement and define the tone of voice you’ll use in all communications.

Consistency is key—your brand should be instantly recognizable across all platforms. A cohesive, compelling brand not only enhances credibility but also builds trust and helps your LLC thrive in the long term.

Then there’s all the marketing of your brand that you’ll do. Marketing and client outreach are critical for freelancers looking to stand out. If you’re unsure how to grow your business, consider leveraging resources like startup SEO strategies to enhance your online visibility. Additionally, tools like automated email marketing platforms can simplify communication and help create strong relationships with your customers.

Don’t leave branding and marketing as an afterthought. Treat it as an integral part of your business plan, just like setting up your LLC. If you do, you’ll lay the groundwork for long-term business success.

Wrapping it up

Starting an LLC from your freelance work is a big step towards professionalizing your business and securing both your personal and business assets. However, common mistakes can hinder your success. By avoiding the mistakes we mentioned in this article, you can avoid costly errors. Additionally, establishing strong branding and a marketing plan from the start can set you apart in a competitive market.

Remember, setting up your LLC is just the beginning. Ongoing research, planning, and seeking expert advice will ensure you’re on track for long-term success. Take the time to set your freelance business up correctly, and it will pay off as your business grows.

If you’re tired of the cubicle life and ready to do work you love, make more than you ever thought possible, and enjoy ultimate freedom, Millo is the right place for you. Join our community today by subscribing to our newsletter, and turn your freelance work into your full-time business.

Keep the conversation going…

Over 10,000 of us are having daily conversations over in our free Facebook group and we’d love to see you there. Join us!