While not everyone thrived on the work-from-home model, in 2020-2021, a large group—the introverts—truly did. Working away from the social pressures of an office, navigating politics, coming up with small talk, and just the energy that it takes to socialize really does appeal to some people.

Raising my hand here, because I myself am an introvert.

There are a lot of jobs out there that don’t require tons of human interaction, but many of them do require a degree or some kind of advanced training. Tax auditors, for example, don’t spend a lot of time chit-chatting, but they need a bachelor’s degree and likely their CPA license. IT workers can often get away with being isolated while they work on computers, but again, most IT positions will require a college degree, even if they are a remote position.

So where does that leave someone who likes to work alone but doesn’t have a formal higher education? What are the best jobs for introverts without a degree?

From online influencers to e-sports players, new types of jobs are in abundance. But these jobs aren’t for everyone. What if you are uncomfortable putting yourself out there for everyone to see? What if social media stardom just doesn’t appeal to you? The best jobs for introverts without a degree are out there, you just have to know where to look.

When the pandemic hit, many young people decided to follow a different path than going to a university. Both 2020 and 2021 saw historic declines in enrollment, and although those numbers have started to creep back up, the seismic shift in the way we live and work brought on by COVID-19 proved that there are many ways to do business. Not everyone needs a degree anymore.

There are a large number of teenagers making money in ways that don’t involve mowing lawns or asking if people want fries with their order. Not that those aren’t great ways to make money and contribute to society, they are! The point is that there are so many other options open to workers of any age nowadays.

If you lack a college degree and also don’t love the idea of working in a big group all of the time, you are in good company. Bill Gates famously dropped out of Harvard to found Microsoft, and he is a self-described introvert. Anna Wintour, editor-in-chief of American Vogue Magazine, is surprisingly shy, according to friends and co-workers, and never went to college at all. If they can do it, so can you.

But you need somewhere to start.

That’s why we’ve come up with a list of the best jobs for introverts without a college degree. In this article, we’ll give you 15 ideas of entry-level work you can do on your own, as well as some resources to help you find and apply for open positions or cultivate your own client base.

Bonus: you can read through the whole thing without talking to anyone. (Any other millennials out there who avoid phone calls like the plague? Just me? Ok.) Let’s go.

15 of the best jobs for introverts without a degree

Let’s start with what type of jobs are available. This is not an exhaustive list, but hopefully it sparks some ideas of how and where you can use your skills to get started in the “best jobs for introverts without a degree” hunt.

1. Photographer

Unless you are taking family photos or documenting events, as a photographer, it’s just you, your camera and the subject.

More outgoing people might choose to do weddings or other social gatherings, but if you are extremely introverted and the thought of getting people to smile at you is too much, product photography is a good bet, and something you can sometimes even do from home. All you will need is great lighting, backdrops, and some basic skills to make the subject pop, and soon you could be earning up to $90,000 each year.

Taking photos of babies or one-on-one sessions like high school seniors or professional headshots is also a great way to keep the groups small and conserve your energy.

Photographers don’t need a college degree to get started, but they will need an understanding of light, framing and some technical knowledge of cameras and how they work. Luckily, there are tons of online courses to help you up-skill from the comfort of your home, or you might consider a course or two at your local community center or university.

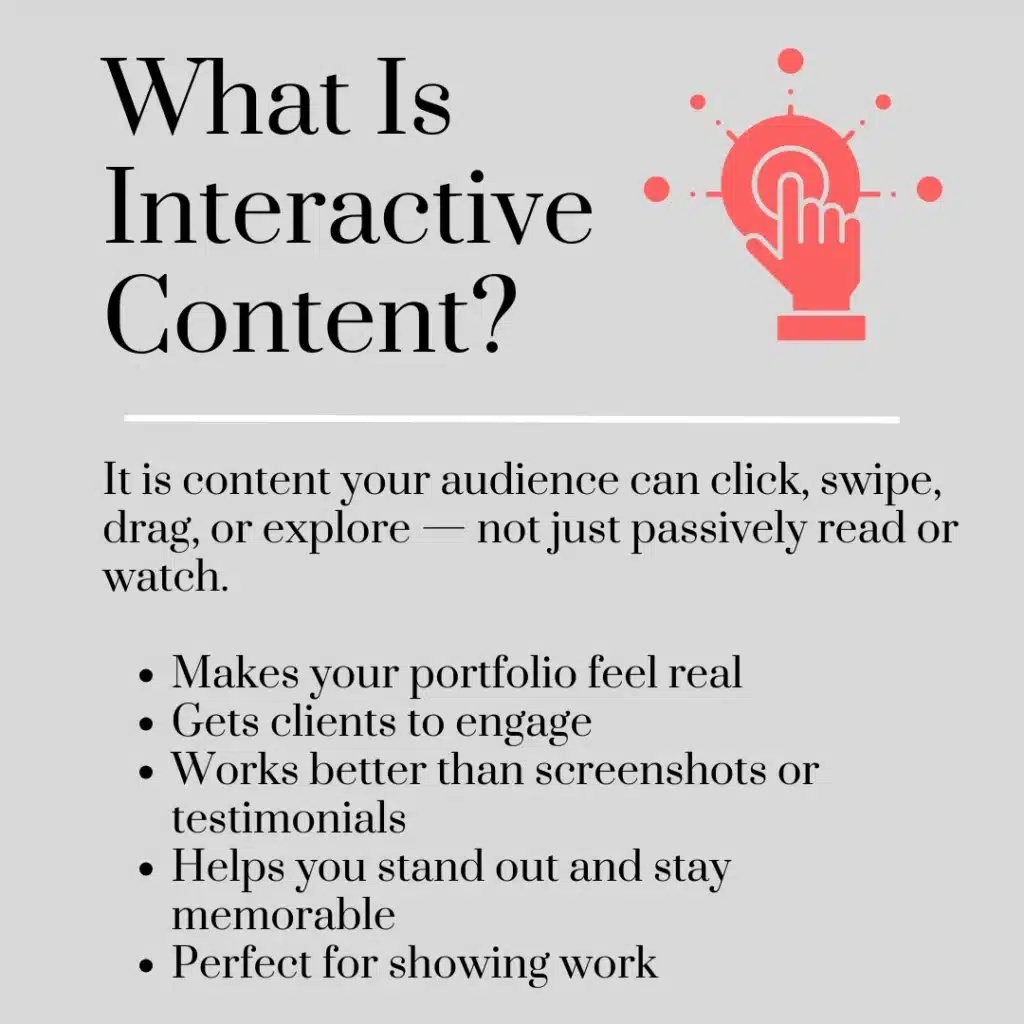

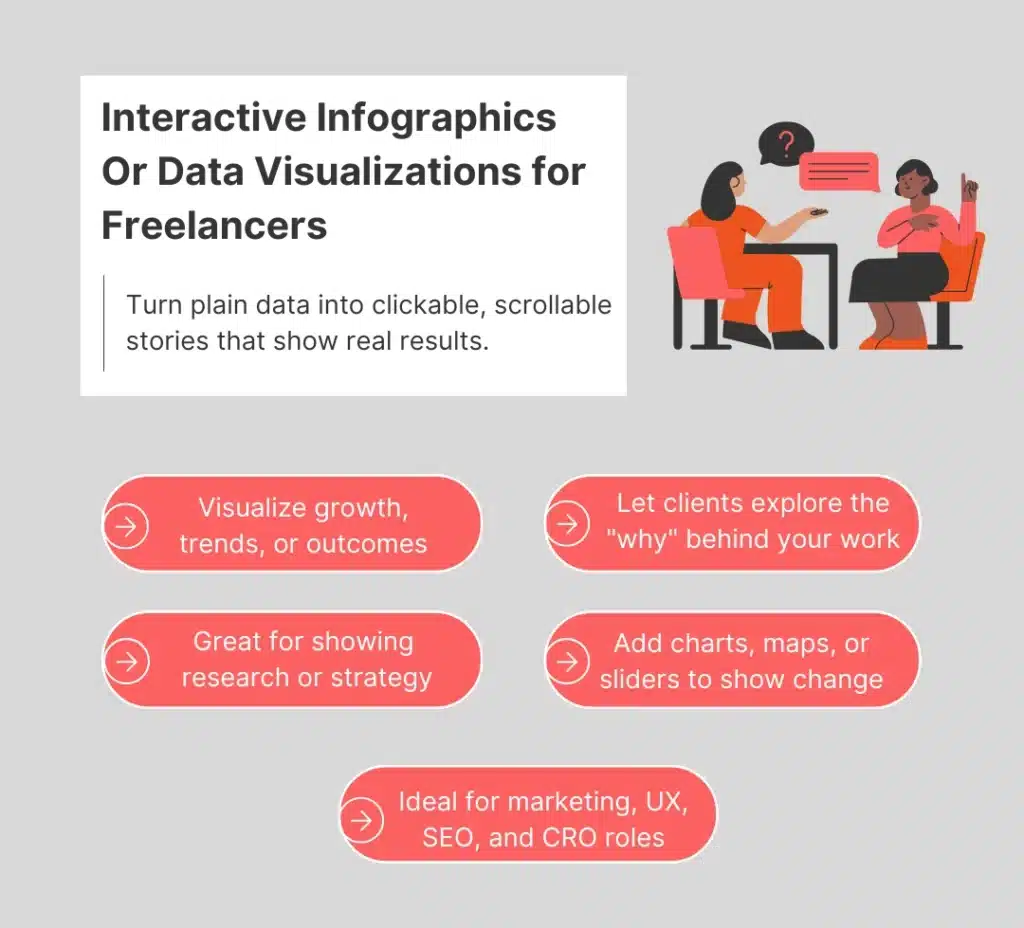

2. Freelance writer

Storytelling has always been an important part of civilization. With the arrival of the internet, the need for content and writers has grown exponentially, and luckily, writing has become one of the best jobs for introverts, since it can all be done from anywhere with just a laptop—no coworkers necessary.

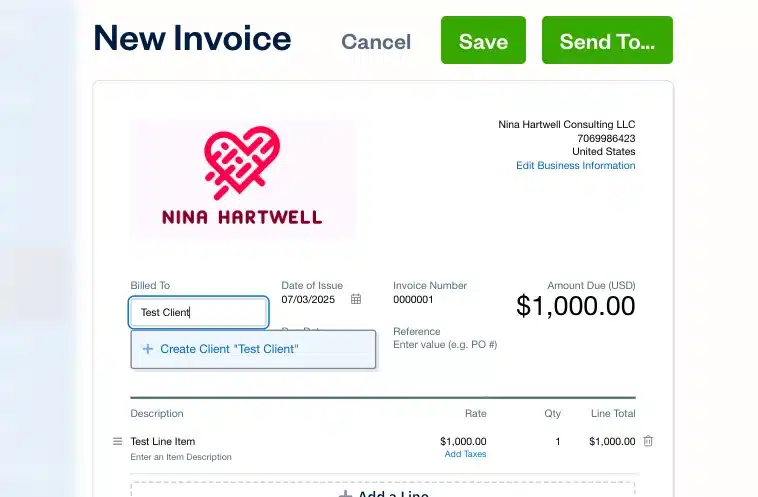

A freelance writer can expect to write everything from social media posts to technical manuals, so it’s important to find a niche that works for you. Keep in mind that, as a freelancer, you will need to do your own marketing and billing, so there are some elements of putting yourself out there involved. However, the actual work can be done in your pjs if that’s how you roll.

A college degree may help with some types of freelance writing. If a company is looking for very in-depth knowledge on a subject matter or someone with a lot of experience, for example, having a college degree can really help you stand out from the crowd. But rest assured, self-taught freelance writers do just fine!

In the age of AI, you might assume that freelance writers are no longer in demand and that tools can handle all content creation. However, the reality is quite the opposite. There’s an increasing focus on human-written content, and AI detector checks are often used to ensure authenticity.

Freelancers set their own rates and also pay their own taxes, so their income is pretty variable, but as a beginner, you can still expect to charge upwards of $20-$30 per hour.

3. Graphic designer

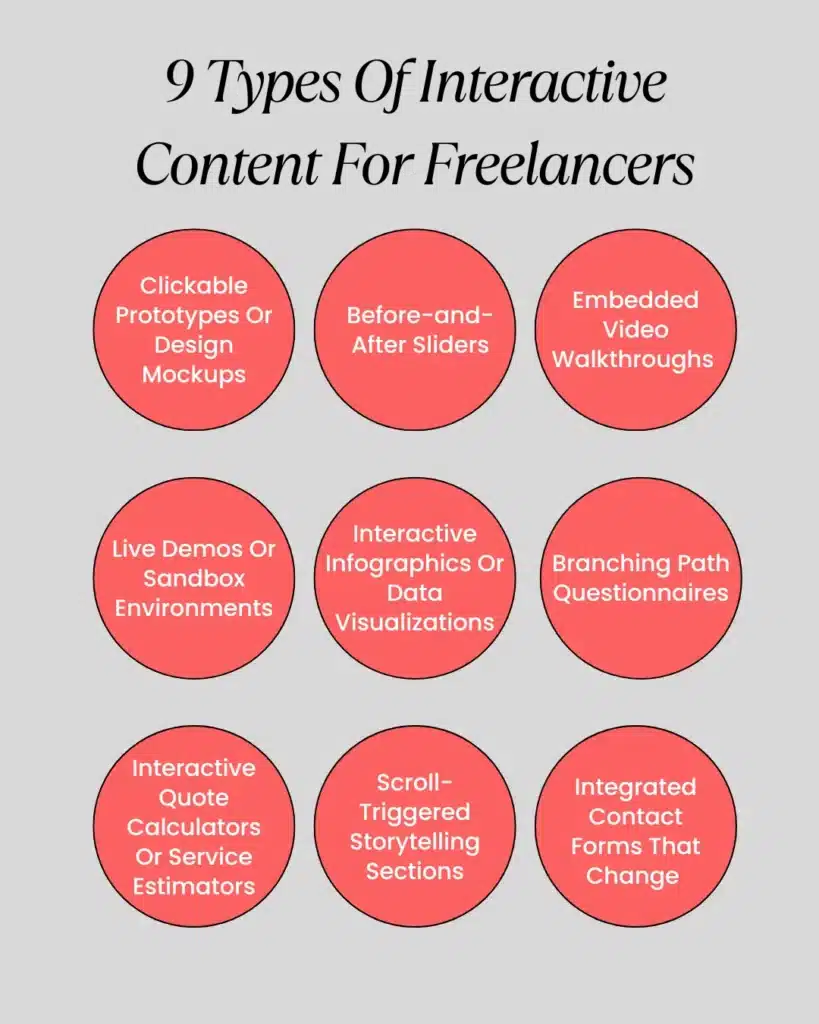

Graphic designers are some of the original work-from-home crowd, so if you are looking for the best jobs for introverts without a degree and you have artistic talent, this may be right up your alley.

Entry-level graphic designers earn between $36-$73k per year. All you need to get started are a computer, design software, and a few classes on proper design.

From there, build up your portfolio by designing for family and friends, volunteering for local organizations and doing projects for fun. In no time you will be ready to become a full-fledged graphic designer.

4. Artist

Artists used to need to be flamboyant and charismatic to attract the attention of patrons and make a good living. Those days are gone!

With platforms like Etsy, Pixpa, UGallery and even Amazon, a career as an artist is right at your fingertips. While you can earn a degree in art, many artists are self-taught, or take classes throughout highschool or in their adult life to pursue their passion.

While art is not always the most lucrative career (the average salary for a freelance artist here in the US is ~$55,000), artist makes the list of best jobs for introverts without a degree because it is so versatile. You can create everything from original paintings to print-on-demand T-shirts in order to sell your art. While you’ll need some marketing know-how, it’s a great job for an introvert with no degree because you get to make your own rules.

5. Web developer

Coders are sort of famous for being introverted or even loners. While this stereotype is being challenged as more and more people go into the computer field, no doubt there are still a lot of website developers who lean to the introverted side of things.

Here are some tips for being a skilled Magento Developer and creating your own store or securing a web development job.

Good news for them—developers are in such high demand these days that most companies are willing to hire them with a lot of flexibility. This means you can probably get a remote position or work on a contract basis to avoid an office setting and do more of the things that center you as an introvert. It also means that you don’t need a degree, just some proven skills.

Web developers make around $70,000 per year when they don’t have a lot of experience, and you can work your way up from there as you grow your skills and confidence.

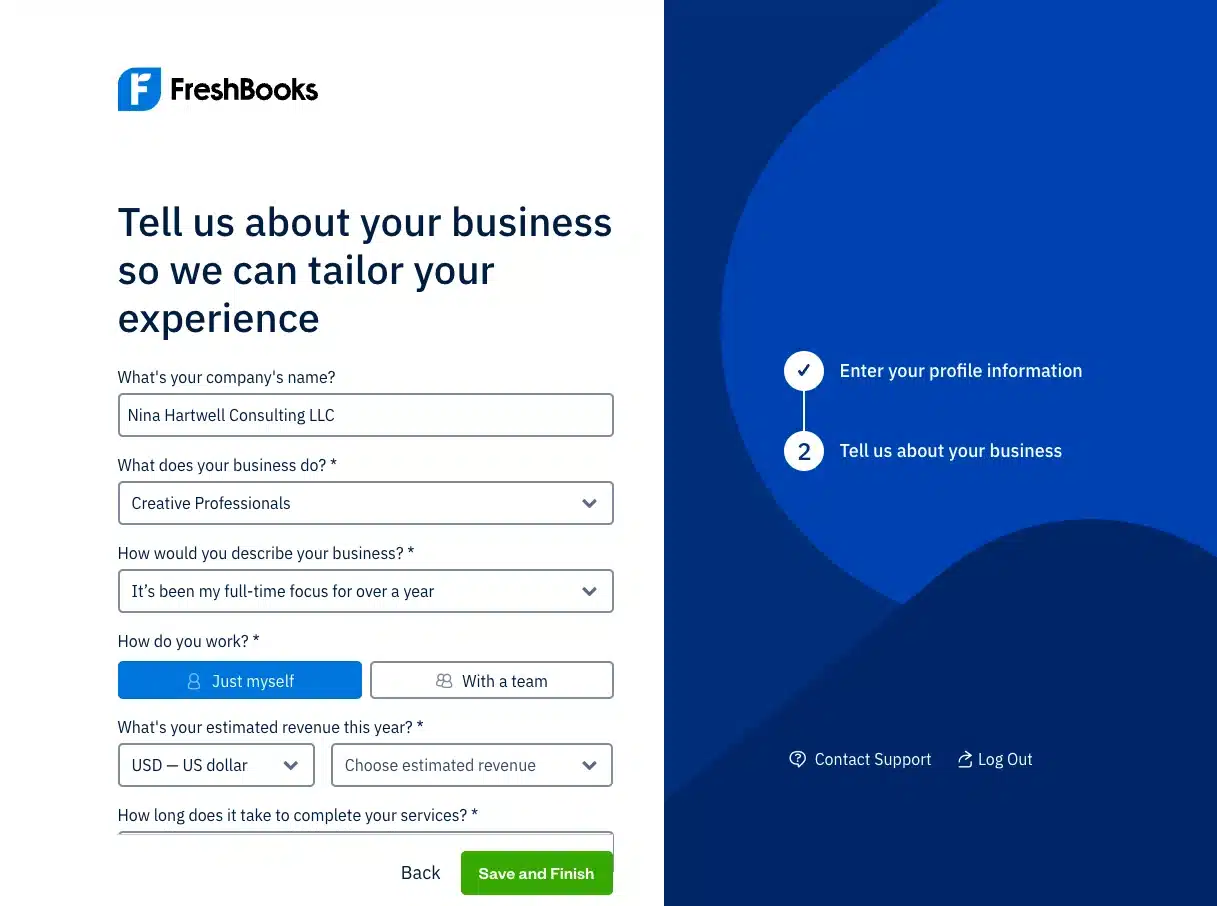

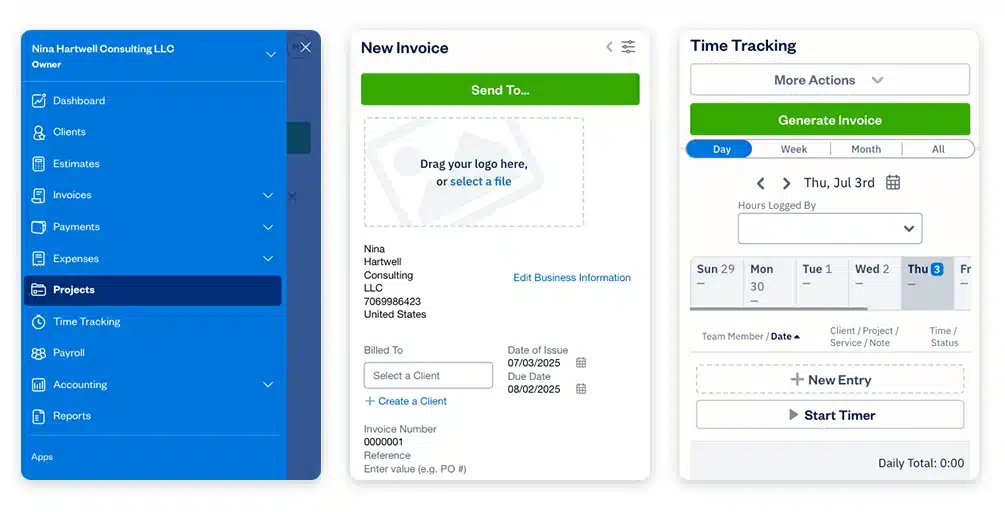

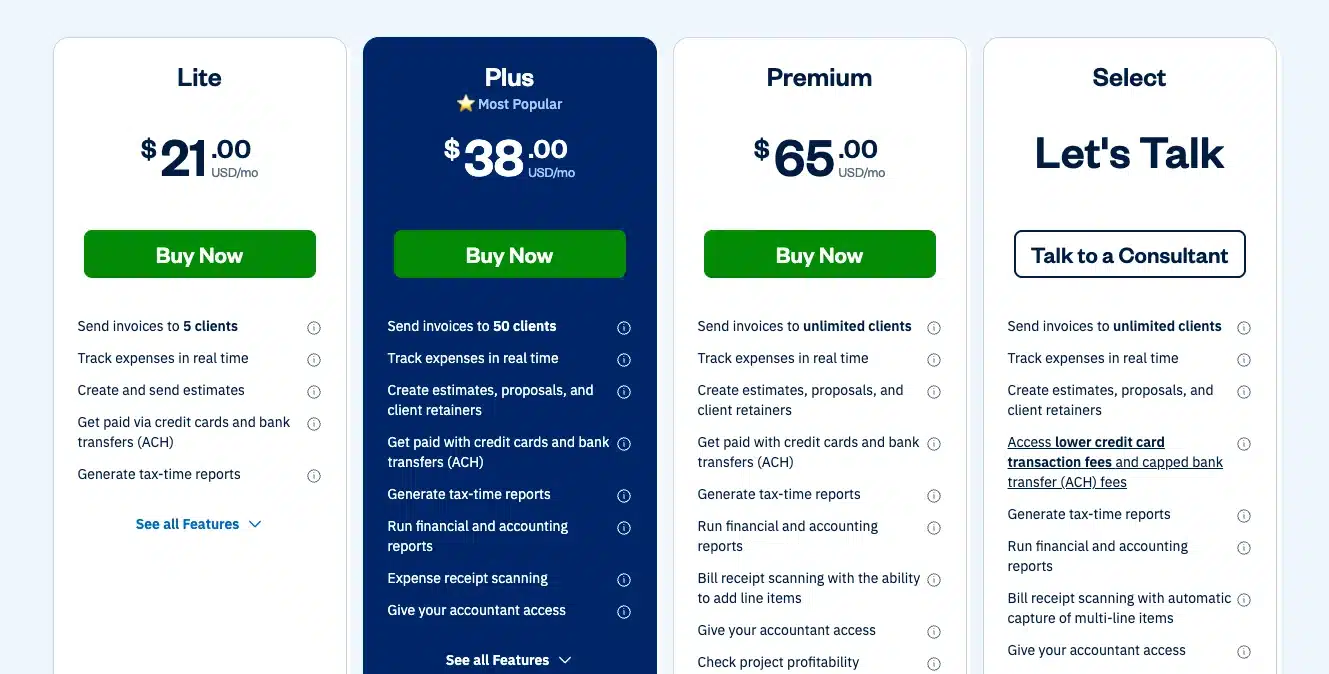

6. Bookkeeper

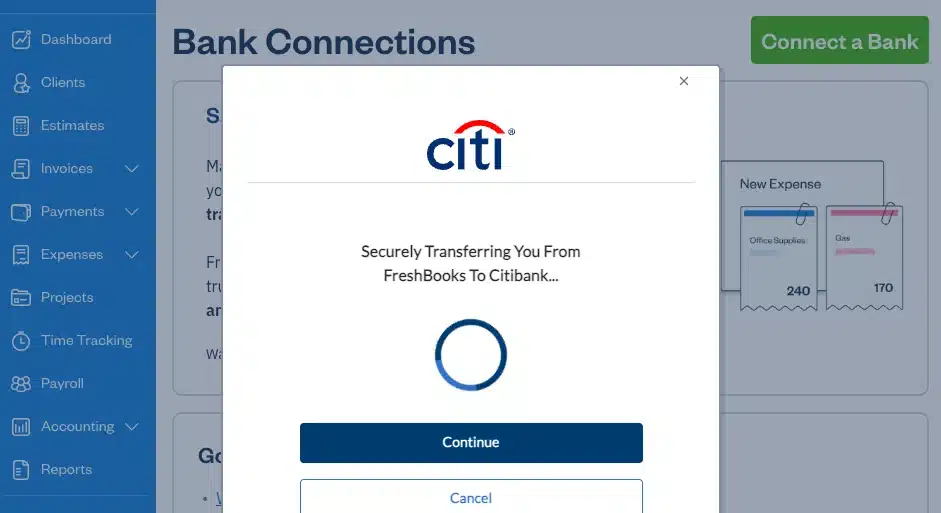

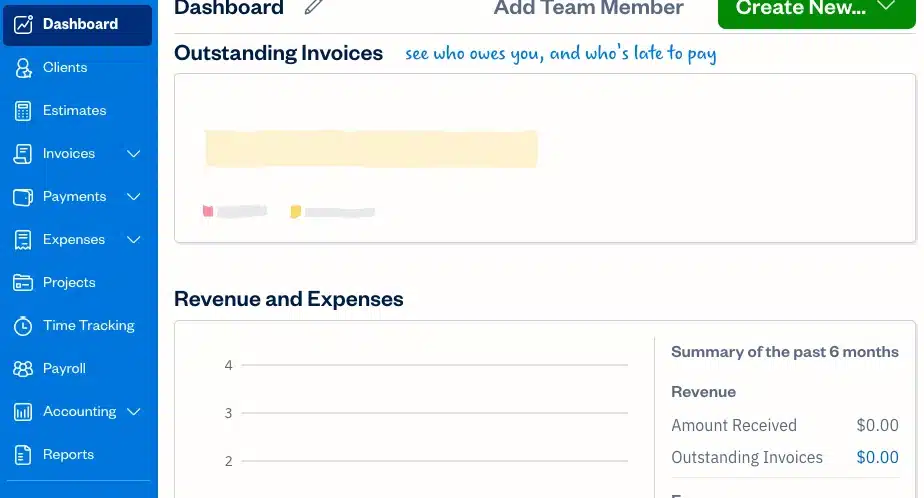

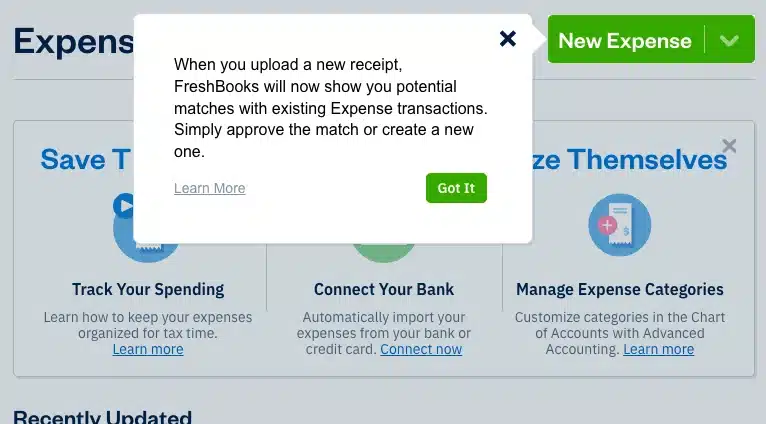

A bookkeeper helps businesses to keep track of their finances. They may track expenses, submit reports, handle payroll or prepare paperwork for taxes, among other things.

Unlike an accountant, which requires a degree, a bookkeeper does not analyze data, provide strategy or file taxes. For introverts, being a bookkeeper can be a great way to find work without having to aggressively sell yourself or spend endless time in meetings. For the most part, you’re just organizing data as it is sent to you.

Bookkeepers earn between $15-$20 hour, on average, making it a great starting point.

7. Blogger

If you like the idea of working completely for yourself, blogging might be one of the best jobs for introverts without a degree in your case.

Bloggers build their own site from the ground up, creating content, usually about a specific topic, and cultivating a community of readers. If you can get enough readers, you’ll soon have the opportunity to sell ads and turn your blog into a job that makes an average of $45,000 each year.

If putting your own name on a blog is anxiety-inducing, you can also write blog posts for other people. Either way, you can work mostly with yourself and, since blogging is a relatively new profession, you definitely don’t need a formal degree to dive in.

8. Translator

If you speak more than one language, working as a translator is one of the best jobs for introverts without a degree, hands down. Most translation jobs prioritize fluency and accuracy over formal education, and many only require a basic skills test to get started.

One excellent opportunity is with Tomedes, a global translation company known for delivering high-quality human translation in over 120 languages. Tomedes frequently works with freelance translators and remote linguists, offering flexible projects that allow for focused, independent work, ideal for introverts. The company values linguistic skill and reliability, not degrees, and provides useful tools to help translators succeed.

As a translator, you can receive assignments from anywhere. While feedback is part of the process, you’ll rarely need to attend meetings or engage in real-time communication.

Translation is also a fast-growing field. As you build your skills, client base, and specialization, you can eventually charge up to $50 per hour or more.

9. Virtual Assistant

Since the 90s, virtual assistants have been popular for busy executives. A virtual assistant is one of the best jobs for introverts without a degree because it can be done from the comfort of your home. However, be aware that, as a virtual assistant, you will work closely with your clients and likely be required to make phone calls and send emails on a regular basis.

The average virtual assistant hourly rate is around $25, so if you are detailed oriented, great at organizing and willing to learn, you can likely build up a solid career in no time.

10. Dog walker

Some introverts are much more comfortable around animals than people. If this is you, the gig economy has opened up a whole new market for dog walkers.

Dog walking makes the list of best jobs for introverts without a degree because there is no specific certification you need, there is a lot of flexibility and your primary function is to care for and interact with dogs.

Dog walkers can make a killing, too—mid range dog walking services cost $20 per 30-minute walk. Depending on the number of dogs you walk, you could easily earn a couple hundred dollars in an afternoon.

11. Mechanic

For more machine-minded folks, working as a mechanic can be very rewarding, and requires neither a degree nor an outgoing personality.

Mechanics don’t need a college education, but will require on-the-job training, and possibly a certificate. But cross that hurdle and it’s one of the best jobs for introverts without a degree.

Instead of dealing with people all day, you’ll deal with engines and car parts, which might not be less unpredictable, but don’t need you to talk to them. Mechanics earn an average of $60,000 each year.

12. Social media manager

Don’t let the word “social” in the title put you off—a social media manager does not necessarily need to interact with other people on a regular basis.

Instead, you need a strong understanding of how people think and feel, which is something introverts tend to be skilled at. You also need to learn how the algorithms of various social media platforms operate. None of this requires a college degree.

Social media managers can earn about $50,000 per year in this behind-the scenes capacity.

13. Filmmaker

You don’t have to love the spotlight to work in the film industry. Cinematographers, grips, editors, prop managers, costume designers and more work in relative isolation.

Some filmmakers have formal education, but many rely on a strong portfolio and the right connections to get a job. Their average starting salary is around $20 per hour.

There is much more to making movies than just what comes out of Hollywood. There are those who make commercials, the live broadcasting industry, departments within large organizations that need events filmed, and one-off jobs like creating wedding videos.

14. Landscaping

Some introverts get energy from being in nature, and if this is you, consider landscaping in your search for the best jobs for introverts without a degree.

Landscaping is a rewarding career that allows you to be outside for much of the year, either constructing new environments or maintaining existing ones. You don’t need a degree to work on a landscaping crew, making it a great place to start.

Keep in mind that, while landscapers earn a solid hourly rate of between $15-$20 per hour, it is seasonal work, so you have to plan carefully for wintertime, either utilizing your skills in a greenhouse, working with snow removal, or saving for the off-season.

15. Private chef

Last on the list of best jobs for introverts without a degree is the culinary field. As a private chef, you are able to be your own boss, make plans from home and work in the background at the events you cater.

Some chefs attend culinary school, but many are self-taught and no degree is required. If you can impress the right people, as a private chef you can make about $45 per person, per meal.

Where to find the best jobs for introverts without a degree

So, you have reviewed the list of best jobs for introverts without a degree, chosen a path that suits you, and you’re ready to find the perfect gig for you.

One problem. How do you start?

The best way to get into any industry is to learn all you can, create a portfolio of your work and some strong references, and then reach out to people you know to see who may be hiring.

Fortunately, there are also a variety of job sites showcasing the best jobs for introverts without a degree. Here are a few of the best:

SolidGigs

SolidGigs is unique in that, instead of you searching for jobs on your own, they will send you a curated list, tailored to your experience and preferences, making it easy to find the perfect fit.

FlexJobs

FlexJobs is a job board with only work-from-home positions, so you’re sure to find some of the best jobs for introverts without a degree by searching through their postings.

Indeed

A more traditional jobs site, Indeed allows you to either search for the type of job you’re looking for, or simply upload your resume and allow recruiters to contact you, which is very convenient if you are an introvert!

Remote.co

Another remote-only jobs site, Remote.co claims to add 130+ jobs each week. Note that not every job is fully remote, some may be part-time on site, or require you to live in the area where the company is located in order to attend occasional events.

Fiverr

Fiverr allows you to post your services or bid on projects. If you’re looking for more of a side hustle or freelance-only gigs, this is a great site for you to start with.

Jobs for introverts are waiting

Whether you are just moving out of your parent’s house, or just looking for a change of pace, the best jobs for introverts without a degree are the ones where you can take charge of yourself and minimize the need for small talk.

From creative jobs like art and writing to more cerebral things like web development and bookkeeping, there are plenty of options out there. It’s up to you to find the field that is most fulfilling for you.

Keep the conversation going…

Over 10,000 of us are having daily conversations over in our free Facebook group and we’d love to see you there. Join us!